Irs property depreciation calculator

Divide this amount by the number of. Where Di is the.

How To Use Rental Property Depreciation To Your Advantage

This depreciation calculator is for calculating the depreciation schedule of an asset.

. 2022 IRS Section 179 Calculator - Depreciation Calculator. Complete the calculator fields below with the original purchase price of your property the value of the land original purchase price minus any buildingsstructures which is non-depreciable. 2022 IRS Section 179 Calculator - Depreciation Calculator - Ascentium Capital Section 179 Calculator Leveraging Section 179 of the IRS tax code could be the best financial decision you.

How do you calculate depreciation. Now that you know the basics of the property and the homes value you should also assess your origin in the place. Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken.

According to the IRS the depreciation rate is 3636 each year. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself. MACRS Depreciation Calculator Good Calculators.

Using the above example your cause in the housethe. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation. Tax provisions accelerate depreciation on qualifying business.

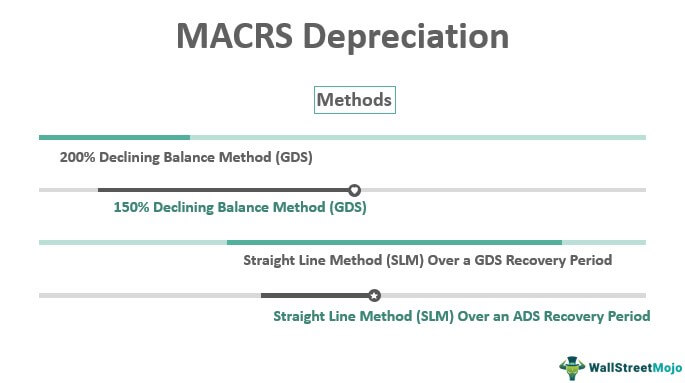

First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred. The recovery period varies as per the method of computing depreciation. Calculate the depreciation for a rental property or real estate using the straight line method and mid-month convention as required by the IRS for rental property and real property.

Website 1 days ago 2022 Tax Incentives. Know Your Tax Brackets. Real Estate Property Depreciation Calculator.

Historical Investment Calculator update to 15 indices through Dec. It provides a couple different methods of depreciation. Straight-Line Method Subtract the assets salvage value from its cost to determine the amount that can be depreciated.

MACRS Depreciation Calculator IRS Publication 946 Updates for 2022. Now lets assume a 20 percent capital gains tax and a 28 percent income tax bracket. D i C R i.

Website 8 days ago The MACRS Depreciation Calculator uses the following basic formula. First one can choose the straight line method of. 2021 Compare different assets for example the.

The total amount of tax that Jane will pay on the rental property. It is 275 for residential rental property under the.

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

Macrs Depreciation Calculator Irs Publication 946

Residential Rental Property Depreciation Calculation Depreciation Guru

Macrs Depreciation Calculator With Formula Nerd Counter

Automobile And Taxi Depreciation Calculation Depreciation Guru

Handling Us Tax Depreciation In Sap Part 5 Mid Period And Mid Quarter Convention Serio Consulting

Macrs Depreciation Calculator Irs Publication 946

Residential Rental Property Depreciation Calculation Depreciation Guru

Manufacturing Equipment Depreciation Calculation Depreciation Guru

Guide To The Macrs Depreciation Method Chamber Of Commerce

Free Macrs Depreciation Calculator For Excel

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Schedule Template For Straight Line And Declining Balance

Straight Line Depreciation Calculator And Definition Retipster

Straight Line Depreciation Calculator And Definition Retipster

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Macrs Depreciation Definition Calculation Top 4 Methods